What is a Business Purchase Agreement?

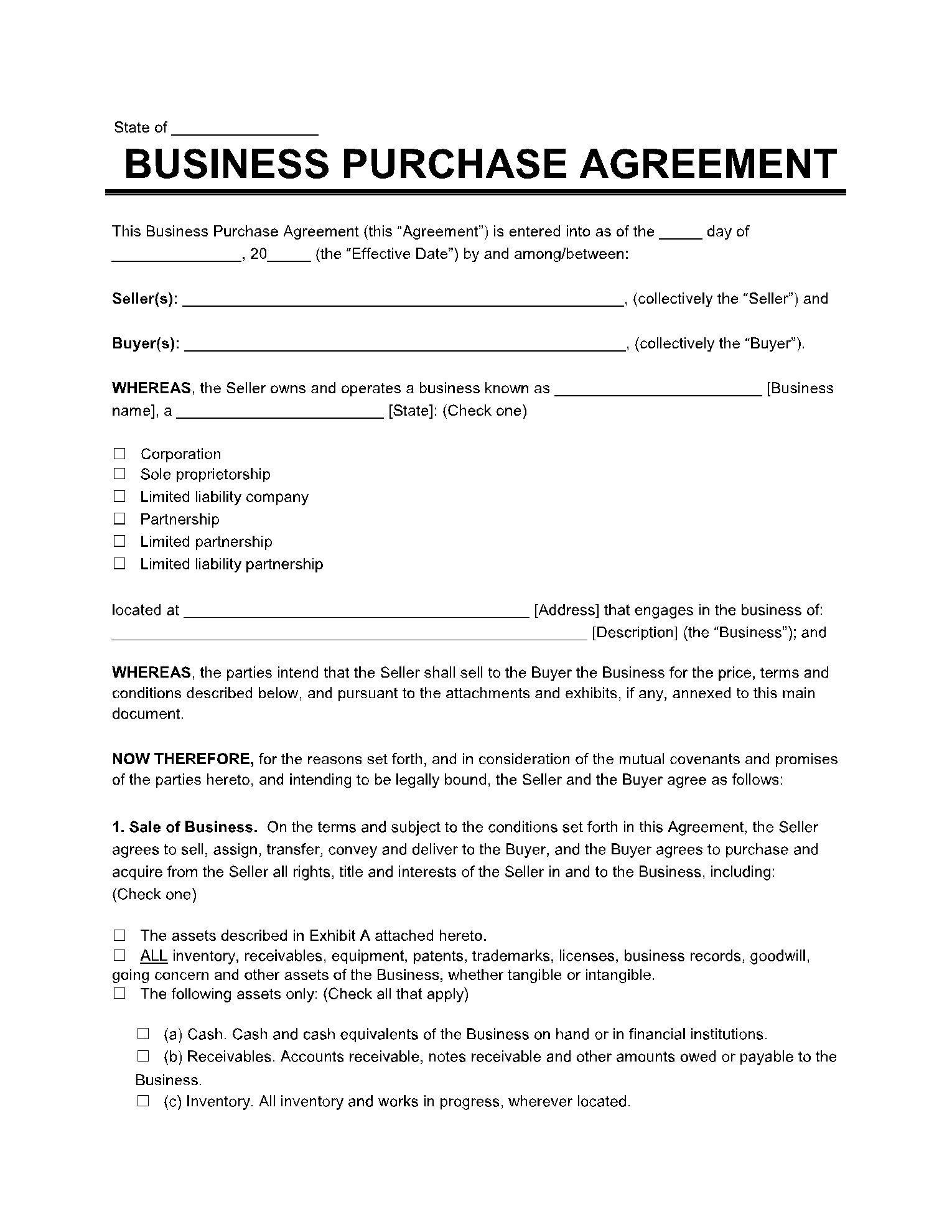

In simple terms, a business purchase agreement is a legal document that shows the transfer of possession or ownership of an existing business from a seller to a buyer.

A business purchase agreement must contain important information for it to be valid, including the date of sale, buyer s name and address, seller s name and address, business name and details, purchase price, date of money transfer, signatures and dates of both the buyer and seller, and witness names, signatures and dates. It should also include the certificate of acknowledgement from a public notary.

At its best, you can use the purchase of business agreement form to buy or sell any business, including eateries, retail stores, restaurants, industrial shops, and professional service offices, and many others.

Who should use a Purchase of Business Agreement?

If you are looking to sell your existing business or you are looking to buy a business, the purchase of business agreement form is for you. The purchase of a business agreement form will help you specify whether or not you want to sell some parts or the whole business. It will also help you determine whether you want to sell the business' assets or shares or both.

What are assets and shares in a Business Purchase Agreement?

In a business purchase agreement, shares are equipment, inventory, confirmed sales orders, business contracts, books, files, and records, trademarks, goodwill and business name. On the other hand, assets include cash and bank balances, securities, records of excluded assets, accounts receivable, and purchase of shares.

How Do I Sell My Business?

The process of selling a business is the same in all states in the US, the only exception is the individual state laws regarding the sale of a business. If you are to sell your business, then we have got you covered.

The first step is to look up what your state laws say about selling an existing business. The essence of this is to ensure you are not contravening both state and federal laws. After that, the next thing is to determine the worth of your business. Whether your business is worth $10 million or $100 million dollar, clearly state it in the business bill of sale form.

The next step is to prepare your financials with your accountant. Let your accountant clearly state your profit and loss as it were. Find an investment banker or a broker to help you facilitate the transaction. An investment banker will help you sell the business at a higher valuation. The next step is to develop the executive summary of your business.

Advertisement is the next point of call. Promote your business to interested buyers. You will start to receive orders from buyers. The investment banker will help you negotiate the best deals. After the buyer's due diligence, you can then proceed to sell your business. Sign the final contracts and handover the business document to the new owner.

Business Bill of Sale vs. Purchase or Sale Agreement

A sales purchase agreement is a legal contract obligating a seller to sell and a buyer to buy a product or service. It's mostly used in all types of businesses. A sale agreement will dictate terms of sale, contains information about buyer and seller, serves as a record for deposits made during negotiations, and creates a record of transactions that have already occurred. It also serves as the official record of a sale.

On the other hand, a business bill of sale is a piece of evidence that the ownership of the item has been transferred from the seller to the buyer as proof that the goods have exchanged hands. A bill of sale occurs after the transaction has been made.

How to Fill Out the Business Bill of Sale?

Filling the business bill of sale form is not difficult. Here at CocoDoc, we have simplified the process. It is very simple and straightforward, as far as you can follow instructions.

However, keep in mind that a valid business bill of sale form must contain the information like the date of sale, buyer s name and address, seller s name and address, business name and details, purchase price, date of money transfer, signatures and dates of both the buyer and seller, and witness names, signatures and dates.

Another important information to include is the certificate of acknowledgement from a public notary. If you need help writing the business bill of sale, you can count on us to deploy our writing prowess to craft something for you.

Conclusion

Okay, there you have it. You can now see that buying or selling an existing business is not difficult. When you are ready to sell your business, you need a business purchase agreement form to show that a transaction occurred. The form must contain important information for it to be valid, including the date of sale, buyer s name and address, seller's name and address, business name and details, purchase price, date of money transfer, signatures and dates of both the buyer and seller, and witness names, signatures and dates.

Whether you want to sell your fashion store or mechanic workshop, the business bill of sale form will protect you from disagreements and fraud in the sale process. If the process of writing the business purchase agreement seems overwhelming, our experts at CocoDoc can help you out. Feel free to reach us at your convenience.